| StockFetcher Forums · Filter Exchange · A NEW ^VIX TRADING SYSTEM | << 1 2 3 4 5 ... 49 >>Post Follow-up |

| StefanM 25 posts msg #130891 - Ignore StefanM |

9/6/2016 3:27:59 AM @Kevin, did you create a Mulri-System in StrataSearch and then run a Walk-Forward Analysis? I also use StrataSearch, but it is not so easy for me to understand, German is my first language and my trading style has been more discretionary, so all this is quite new to me .. |

| Kevin_in_GA 4,599 posts msg #130892 - Ignore Kevin_in_GA |

9/6/2016 7:38:33 AM No - it is very challenging to run a WFA on a multi-system since it typically uses 4-12 different settings per system which each need to be periodically re-evaluated (e.g., once per month) - raised to the 20th power since it must be done on all 20 systems in the multi-system each time. The goal of a WFA is to see how a system does against new (out-of-sample) data, which I did using the period 1999-2009. |

| StefanM 25 posts msg #130893 - Ignore StefanM |

9/6/2016 8:57:25 AM Sorry but I only understand partially what you mean. What I want to understand is how you get the 2 equity curves for 20 different setups. Obviously you combine them. You run a brute force, find the 20 systems, and combine them in a multi strategy setup? This brings up your first equity curve. And how do you bring up the second curve with the out-of-sample data? I did not understand if the curve is the result of a WF analyse, of it you used another tool of StrataSearch. I do not ask so much about details of your strategy but more about a "how-to" in StrataSearch .. |

| Kevin_in_GA 4,599 posts msg #130895 - Ignore Kevin_in_GA modified |

9/6/2016 9:50:04 AM You combine the 20 systems developed against the data from 2011-2016 into a multi-system. Then you change the trade settings to run over a new period (I chose 1999-2009) and you run the multi-system against that period. That is how the second curve and stats are developed. I do not ask so much about details of your strategy but more about a "how-to" in StrataSearch That is what I would like to avoid here - I would rather have this thread be focused on the trading system itself rather than how to do things in Stratasearch. I would suggest reviewing the documentation and looking through the forums over at Stratasearch.com - you will find the answers to most of your questions. Thanks, Kevin |

| StefanM 25 posts msg #130898 - Ignore StefanM |

9/6/2016 12:08:06 PM Yes of course, I understand you. Thank you .. :-) |

| Kevin_in_GA 4,599 posts msg #130900 - Ignore Kevin_in_GA modified |

9/6/2016 12:40:20 PM Weird day - the ^VIX index is up right now (+2.2%) but VXX is DOWN -1.78%. That is pretty crappy tracking if you ask me. I placed a limit order for 1000 shares of VXX at $34.00. Waiting to see of it fills. 14:55 PM - order filled at $34.00. |

| shillllihs 6,093 posts msg #130901 - Ignore shillllihs |

9/6/2016 12:43:55 PM All I could say about Tvix is, August 24, 2015 Vix spiked big, It took Tvix until sept 1st to spike to its high. Might just be delayed. Maybe 1 day when you find time, you can create an all in 1 SF. friendly watered down version of these. |

| Mactheriverrat 3,172 posts msg #130902 - Ignore Mactheriverrat |

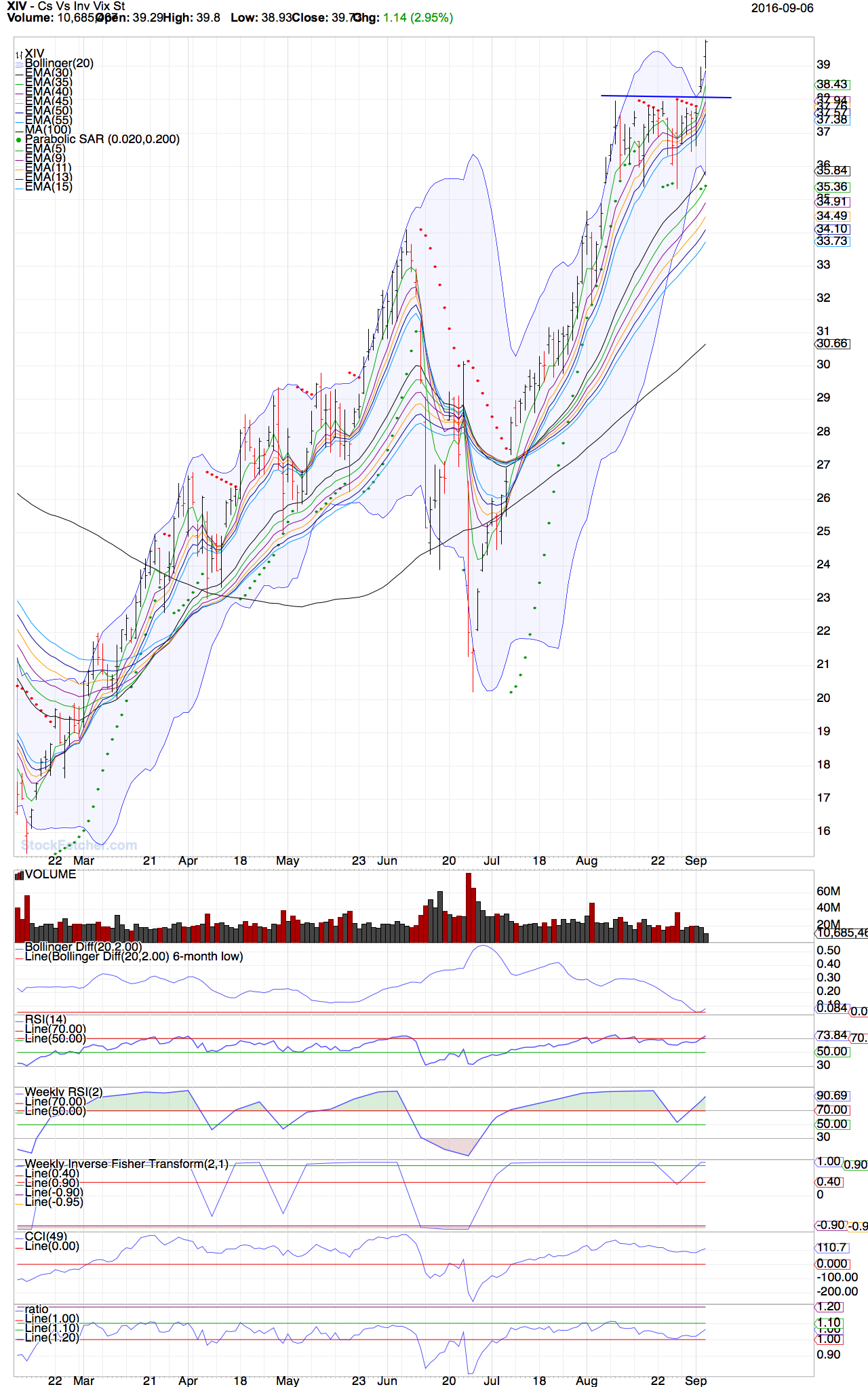

9/6/2016 2:30:28 PM So goes XIV , So goes SPY. XIV a few says faster than SPY. Just saying!  |

| Kevin_in_GA 4,599 posts msg #130910 - Ignore Kevin_in_GA modified |

9/6/2016 4:13:06 PM Looks like a new LONG entry signal from VIX LONG SIGNAL #2. Not sure if the open short position will trigger an exit - I will confirm both tonight with the Stratasearch nightly email of these signals. Right now I am holding 2 units of 1000 shares each (my chosen unit size). Therefore I do not need to enter another long position tomorrow if the signal is confirmed - you can act on this signal as you see fit. UPDATE: The Stratasearch filters are indicating no new positions. |

| mahkoh 1,065 posts msg #130915 - Ignore mahkoh modified |

9/6/2016 5:15:32 PM First of all, great work again Kevin! I would say that futures would be the trading vehicles that at least to some extent mimic VIX moves, but this obviously would not work for simultaneous long and short positions unless you choose different expirations for long and short trades. This comes with its own challenge, today's range for Sept futures was nearly 5 %, Oct expiration about 3 % and Nov expiration 2 % A better idea may be VIX options, although it is rarely a good idea to trade options at the open.There is some serious skew going on in these options. With VIX at 12.00 Sept 13 expiration's 12 strike has a bid/ask of 0.95 - 1.25 for the calls and 0.05 - 0.15 for the puts.The 12 calls give you 0.9 delta, if you want equal delta for the puts you'll have to go out all the way to the 16(!) strike. I think the best one could do is sell Sept 20 10 calls as proxy for short positions and buy Sept 20 10.5 calls if you get signals to go long. Deltas are over 0.99 for both and spreads 20 cents. It appears 10 is the the lowest available strike. On a side note: SF signals will not be valid until prices for VIX are updated. What you can do is add the following to the filters: add column ind(^VIX,close) If this column shows 0 SF uses yesterday's close and the signal is not yet valid. |

| StockFetcher Forums · Filter Exchange · A NEW ^VIX TRADING SYSTEM | << 1 2 3 4 5 ... 49 >>Post Follow-up |