| StockFetcher Forums · Stock Picks and Trading · Follow The Money (Options) | << 1 ... 18 19 20 21 22 ... 31 >>Post Follow-up |

| BoCap 18 posts msg #141566 - Ignore BoCap |

1/30/2018 4:43:24 PM Thanks Tuan, But i have question, with all the setting done as you said, Now what do i look for ? Big block of quantity , trade notional is Dollar value ? like today search result that showing QQQ : 10:26am June 15th / Put with 40,000 qty and over 12mln $ ?? Am i looking at the right one ? Are we suppose to look for Notation with dollar value over 1 million and higher to get a better probability of winning ? |

| 15minofPham 171 posts msg #141576 - Ignore 15minofPham |

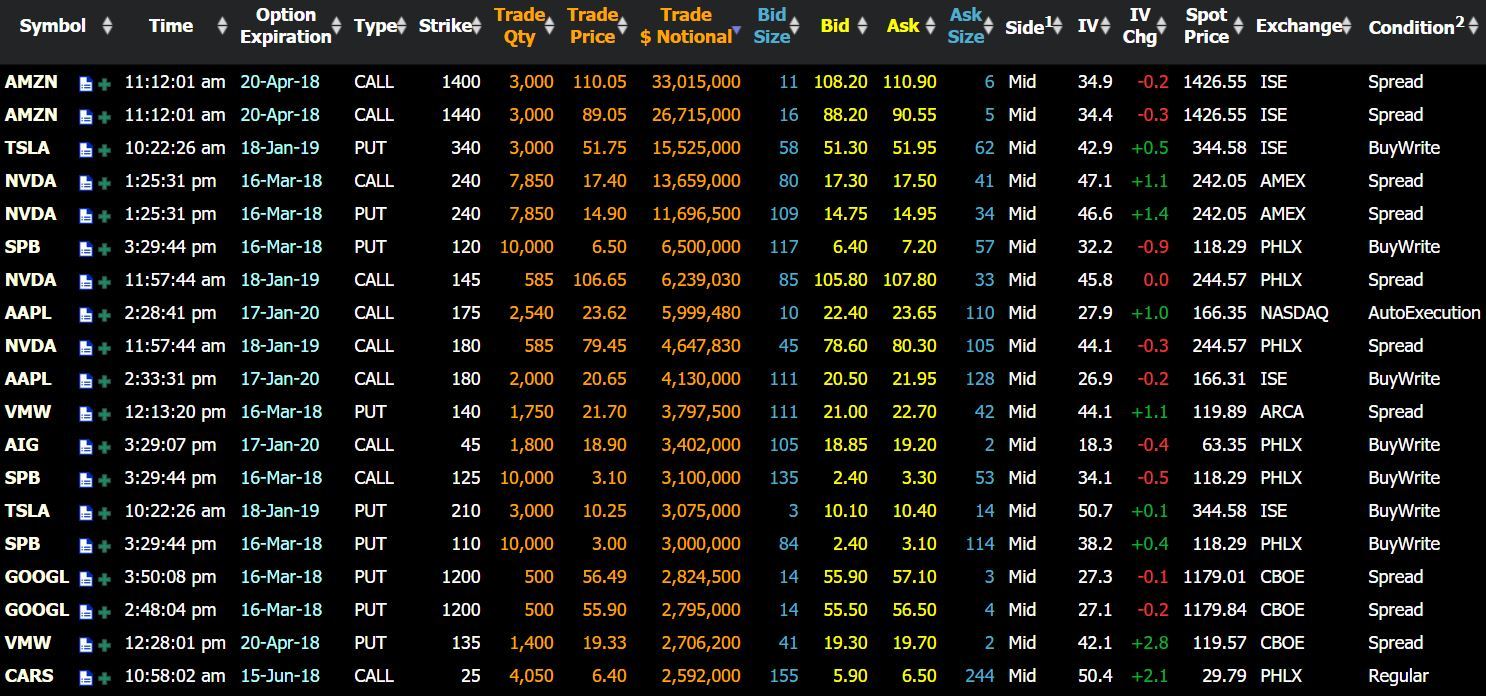

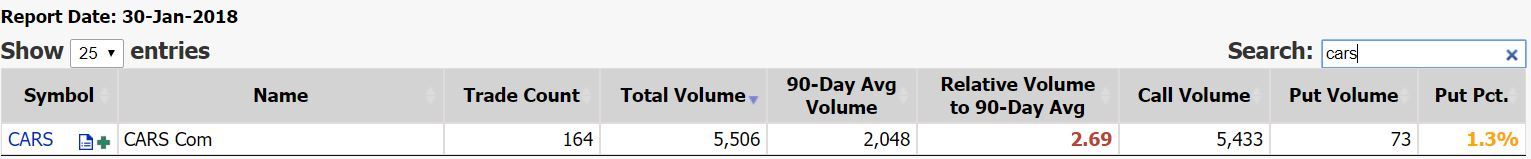

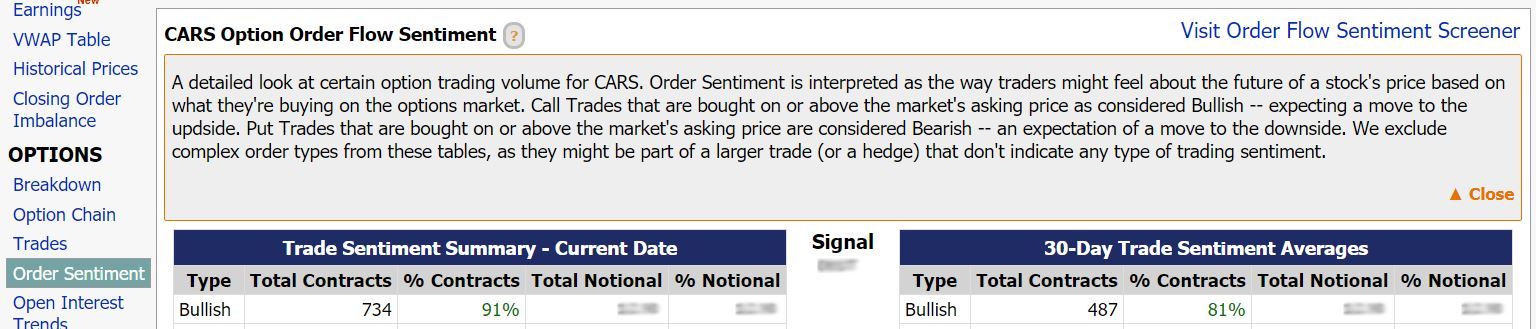

1/30/2018 11:32:29 PM Big Option Play of the Day - CARS Premium of $2.6 million on 4,050 of the 6/15/18 $25 Call for $6.40 with stock at $29.79. Daily chart shows it's at support while weekly shows at 8 EMA. Earnings is on 2/21 and what's interesting is 2/16 30 Call has nearly 10,000 in open interest suggesting that option players think it will make a run into earnings. Break even of $31.40 is 5.8% above today's closing price of $29.68. Total Call/Put option volume percentage was an amazing 99-1 and bullish order sentiment was 91%, above its 30-day average of 81%. Mahkoh has a great play in CTXS, but that's more a LEAP and since I trade for a living, I like to pick plays that has a closer expiration. LEAPs are great for retirement accounts as they are much more forgiving hence much safer. ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ Monday's spotlight - AMZN, $16.3 million, 3,000, 3/16/18 $1450 Call $58.00, Stock $1415 Today's market bloodletting did nothing to stop the juggernaut known as Amazon. It says, "Please, bloodletting are for amateur stocks" as it gained 1.42% to help the option price jump to $74.85, a gain of 29%. The $64,000 question is everything already priced in for earnings on 2/1? ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ AKS became the third loser as it reported horrible earnings and hit our stop loss at -50%. Most of the plays in the portfolio are further out so that's why the moves aren't fast. Couple that with today's crater and surprisingly we see still more green than red. This is another example why newbies should stick with plays at least 4 months out. Caught flat footed on options expiring in one to two months on days like today make it much more difficult to recover especially if you have a very small account!  |

| BoCap 18 posts msg #141578 - Ignore BoCap |

1/30/2018 11:58:57 PM CARS: How did Cars come up under your search Tuan ? I filtered a search with Chameleon with Over 500, Over.25, Ask and above, QTY>OI and CARS did not show up , I also tried it with StoppedIM or Auto, or ANY and still did not see CARS, what have i done wrong ? |

| lavapit315 47 posts msg #141585 - Ignore lavapit315 |

1/31/2018 4:22:59 AM @BoCap Its at the "Mid" price. |

| sandjco 648 posts msg #141588 - Ignore sandjco |

1/31/2018 8:06:44 AM @15min... RE: call to put ratio is this data on marketchamelon as well? sorry if i missed it. thanks in advance |

| lavapit315 47 posts msg #141592 - Ignore lavapit315 |

1/31/2018 8:47:07 AM @sandjco Its available but only with a paid account. Otherwise it grayed out. |

| sandjco 648 posts msg #141594 - Ignore sandjco |

1/31/2018 8:55:49 AM @lava.. many thanks! must be one of the differentiator say vis a vis SGMS (albeit CARS didn't break down thru EMA50 and SGMS did). |

| mahkoh 1,065 posts msg #141627 - Ignore mahkoh modified |

1/31/2018 1:39:23 PM SQ up some 3% since mentioned on 1/23 keeps attracting call buyers. Noteworthy today nearly 5000 contracts for the March 38 strike, representing a bet of $ 4.5 mln. Underlying now at 46.52. |

| four 5,087 posts msg #141631 - Ignore four |

1/31/2018 1:58:31 PM https://www.forbes.com/sites/greatspeculations/2018/01/30/call-buyers-hit-a-winner-with-extreme-networks-stock/#381313b87aae Shares of network infrastructure equipment maker Extreme Networks just touched a 16-year high on news the stock will be added to the S&P SmallCap 600 Index. At the time of this writing, EXTR is trading up 9.1% at $15.01, bringing its 12-month advance to 172%. In fact, the shares have closed eight straight quarters in positive territory. Call buyers have been enjoying the run, too. |

| 15minofPham 171 posts msg #141636 - Ignore 15minofPham |

1/31/2018 4:26:13 PM Bo, Lava is correct. I cheated and used Mid instead of Ask & Above. Many times big boys try to hide their plays by buying near the high like CARS. Notice its $6.40 purchase price is closer to the Ask $6.50. This means the Call was bought instead of sold.

Sandjo, The TOTAL Call/Put option volume is FREE. Go to "OPTIONS" at the top of the menu, then choose "OPTION VOLUMES", then type the symbol into the "SEARCH" box.

Order Sentiment can be found under "OPTIONS" menu on the LEFT hand side.

The reason why I didn't choose SGMS yesterday was its March expiration was too close to its earnings around end of February to beginning of March. If you're wrong, your option premium will be eviscerated with very little time to recover. HTH |

| StockFetcher Forums · Stock Picks and Trading · Follow The Money (Options) | << 1 ... 18 19 20 21 22 ... 31 >>Post Follow-up |